From automation to intelligence: learn how RPA and AI are redefining BFSI. This article provides a broad look at a solution-based approach.

Table of Contents:

- Introduction

- Navigating Contemporary Challenges in BFSI

- Potential of RPA and AI in BFSI:

- Solutions for Post-Implementation Challenges

- Why Adopt RPA and AI Together?

- Empowering and Elevating RPA and AI in BFSI

- Maximizing Impact: The Synergy of RPA and AI

- Conclusion: The Road Ahead

Introduction

In today’s rapidly evolving business landscape, the Banking, Financial Services, and Insurance (BFSI) sector is at the forefront of digital transformation. To succeed in this dynamic environment, industry leaders, executives, and decision-makers must not only recognize the challenges but also harness the opportunities presented by technology. This article is a comprehensive exploration of how Robotic Process Automation (RPA) and Artificial Intelligence (AI) provide strategic solutions to address these challenges, foster innovation, and drive growth within the BFSI sector.

Before delving into their applications, let’s establish a clear understanding of RPA and AI. RPA utilizes software robots to automate repetitive tasks, while AI leverages machine learning and data analytics to replicate human intelligence. In BFSI, these technologies have the potential to reshape the way business is conducted.

2. Navigating Contemporary Challenges in BFSI

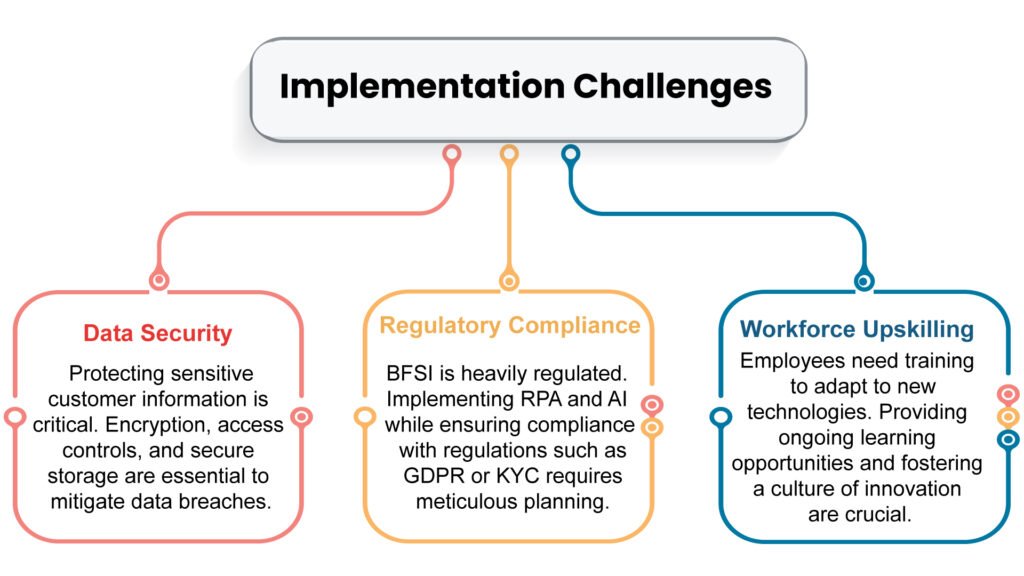

Before embarking on the journey of RPA and AI implementation, it’s crucial to acknowledge the pre-implementation challenges. Data security and regulatory compliance are critical in the financial services industry. Protecting sensitive customer data while adhering to strict industry regulations presents a complex puzzle. Furthermore, upskilling the workforce to adapt to these transformative technologies is a challenge that cannot be underestimated by CFOs, COOs, and industry professionals.

3. Potential of RPA and AI in BFSI:

RPA holds the power to streamline BFSI operations by automating laborious tasks such as data entry, transaction processing, and report generation. This not only reduces errors but also significantly improves operational efficiency. In parallel, AI ushers in a new era of data-driven decision-making within the sector. AI can predict market trends, detect fraudulent activities in real-time, and offer highly personalized product recommendations to customers. These capabilities lead to better customer experiences and more informed strategic decisions.

4. Solutions for Post-Implementation Challenges:

BFSI is an industry where every decision counts, embracing technology has become synonymous with staying competitive and relevant. As seasoned COOs, CFOs, banking professionals, and industry leaders, it is important to understand that the transformative power of Robotic Process Automation (RPA) and Artificial Intelligence (AI) can’t be ignored. While the potential of RPA and AI in BFSI is clear, the path to realizing these benefits can be laden with challenges. In this context, we present a strategic roadmap, tailored to your discerning vision, to address solutions to post-implementation challenges.

Data Security Measures:

- Encryption: Implement strong encryption protocols to safeguard data both in transit and at rest.

- Access Controls: Enforce strict access controls, ensuring that only authorized personnel can access sensitive information.

- Regular Audits: Conduct regular security audits to identify vulnerabilities and address them promptly.

Regulatory Compliance:

- Dedicated Compliance Teams: Appoint teams responsible for monitoring and ensuring compliance with relevant regulations.

- Compliance Audits: Conduct regular audits to verify adherence to regulatory requirements.

- Compliance Software: Utilize specialized compliance software to automate and streamline compliance processes.

Workforce Upskilling:

- Training Programs: Invest in comprehensive training programs for employees, focusing on both RPA and AI.

- Continuous Learning: Promote a culture of continuous learning and innovation within the organization.

- Skill Assessment: Regularly assess employee skill levels and provide targeted training as needed.

Safeguarding the power of RPA and AI in BFSI requires proactive steps. Strong data security, dedicated compliance teams, and continuous workforce upskilling are our shields in this digital frontier.

5. Why Adopt RPA and AI Together?

RPA and AI are a symbiotic relationship, as RPA automates structured processes and AI handles unstructured data and complex decision-making. By combining RPA’s efficiency with AI’s cognitive capabilities, BFSI institutions can streamline operations and make intelligent, data-driven decisions. This results in cost reduction, enhanced customer experience, improved compliance, faster decision-making, and scalability. RPA ensures adherence to regulatory requirements, while AI enables real-time data analysis, facilitating quicker and more informed decisions. BFSI institutions can seamlessly scale RPA and AI solutions to meet growing demands and overcome the challenges of data compliance and regulations.

6. Empowering and Elevating RPA and AI in BFSI

In top 30 U.S. banks, adaptation of RPA resulted in reduced errors and $1M annual cost savings, according to AIMultiple.Considering the application of AI-powered chatbots, offering instant, round-the-clock responses to customer inquiries. Banking chatbots ensure customers receive assistance whenever they need it, enhancing customer satisfaction and loyalty. Furthermore, BFSI institutions are increasingly focusing on mobile and device friendliness, ensuring seamless customer experiences across various devices, thereby elevating the customer journey.

7. Maximizing Impact: The Synergy of RPA and AI

The true magic unfolds when RPA and AI work in harmony. RPA’s proficiency in automating structured tasks complements AI’s capabilities in handling unstructured data and complex decision-making. This synergy allows for comprehensive automation and intelligent decision support. Applications such as chatbots and virtual assistants leverage this synergy to provide real-time customer support and personalized experiences, thereby maximizing the impact of RPA and AI. One of the leading examples in this domain is IBM Robotic Process Automation, which offers many businesses in IT as well as other industries the ease and speed of their software tools to help them complete tasks and achieve digital transformation.

Conclusion: The Road Ahead

Looking ahead, the BFSI sector is poised for further transformation. Future trends include advanced AI applications for predictive analytics, enhanced risk management, and the emergence of autonomous financial advisors. Moreover, the integration of blockchain and distributed ledger technology promises enhanced security, transparency, and trust, setting the stage for BFSI’s continued evolution.

RPA and AI are not just technological innovations, they are strategic imperatives for BFSI executives, COOs, CFOs, and industry leaders. These technologies offer a pathway to a more efficient, customer-centric, and agile future. By adopting RPA and AI as essential tools, BFSI institutions can position themselves for long-term success, continued innovation, and sustainable growth. The revolutionizing potential of RPA and AI in BFSI is not merely an option; it is a necessity.

Visit AITechPark for cutting-edge Tech Trends around AI, ML, Cybersecurity, along with AITech News, and timely updates from industry professionals!